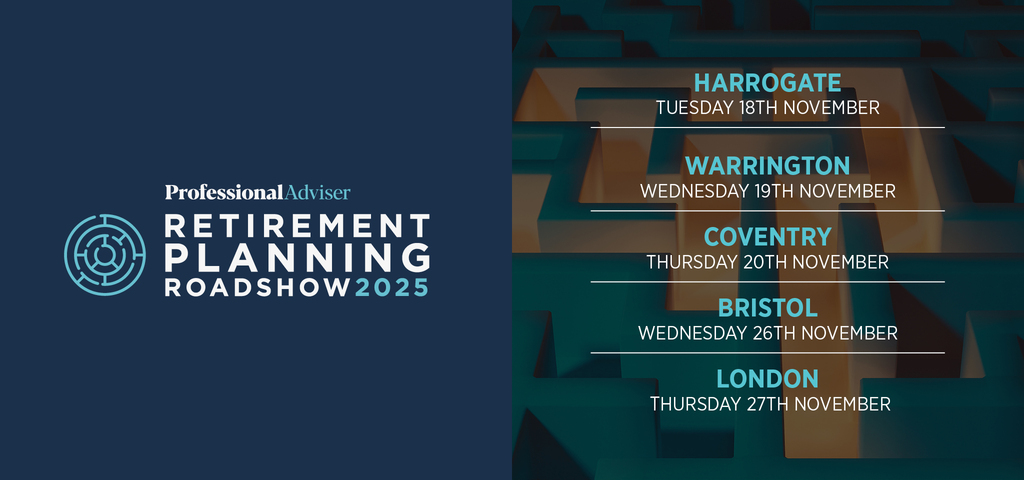

Welcome to the Retirement Planning Roadshow 2025

18th - 27th November

Harrogate | Warrington | Coventry | Bristol | London

Last year’s Autumn Budget included seismic changes for financial advisers, with pensions set to be brought into inheritance tax’s scope from April 2027. Further afield, US president Donald Trump’s tariffs have this year aided market volatility.

The Financial Conduct Authority has had a watchful eye on retirement income outcomes for some years including via its Retirement Income Review, with firms expected to meet good practice standards when working with clients entering or in decumulation. Areas for improvement identified by the regulator have included on record keeping, risk profiling and income withdrawal sustainability.

Even as the financial advice profession digests current changes and challenges, with the Autumn Budget taking place on the 26th November speculation has once again begun to abound over potential tax updates.

Professional Adviser’s Retirement Planning Roadshow will include presentations from leading providers and specialist Q&A sessions to equip your firm with the knowledge it needs to deal with challenges and stay ahead.

We look forward to you joining us for a busy morning of debate at one of our five venues this November.

Roadshow Dates and Locations

Tuesday 18th November - Harrogate - Rudding Park Hotel

Wednesday 19th November - Warrington - The Park Royal Hotel

Thursday 20th November - Coventry - Coombe Abbey Hotel

Wednesday 26th November - Bristol - Leigh Court

Thursday 27th November - London - One Whitehall Place